CREDIT BOOST & MANAGEMENT

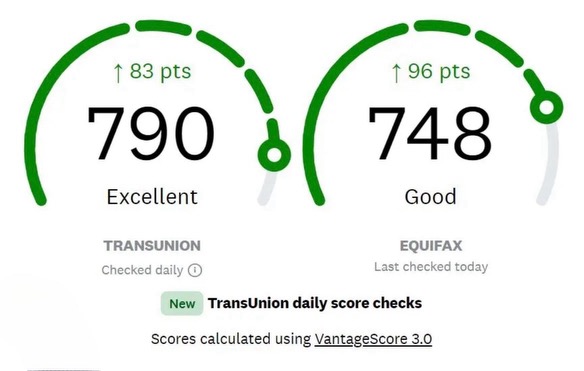

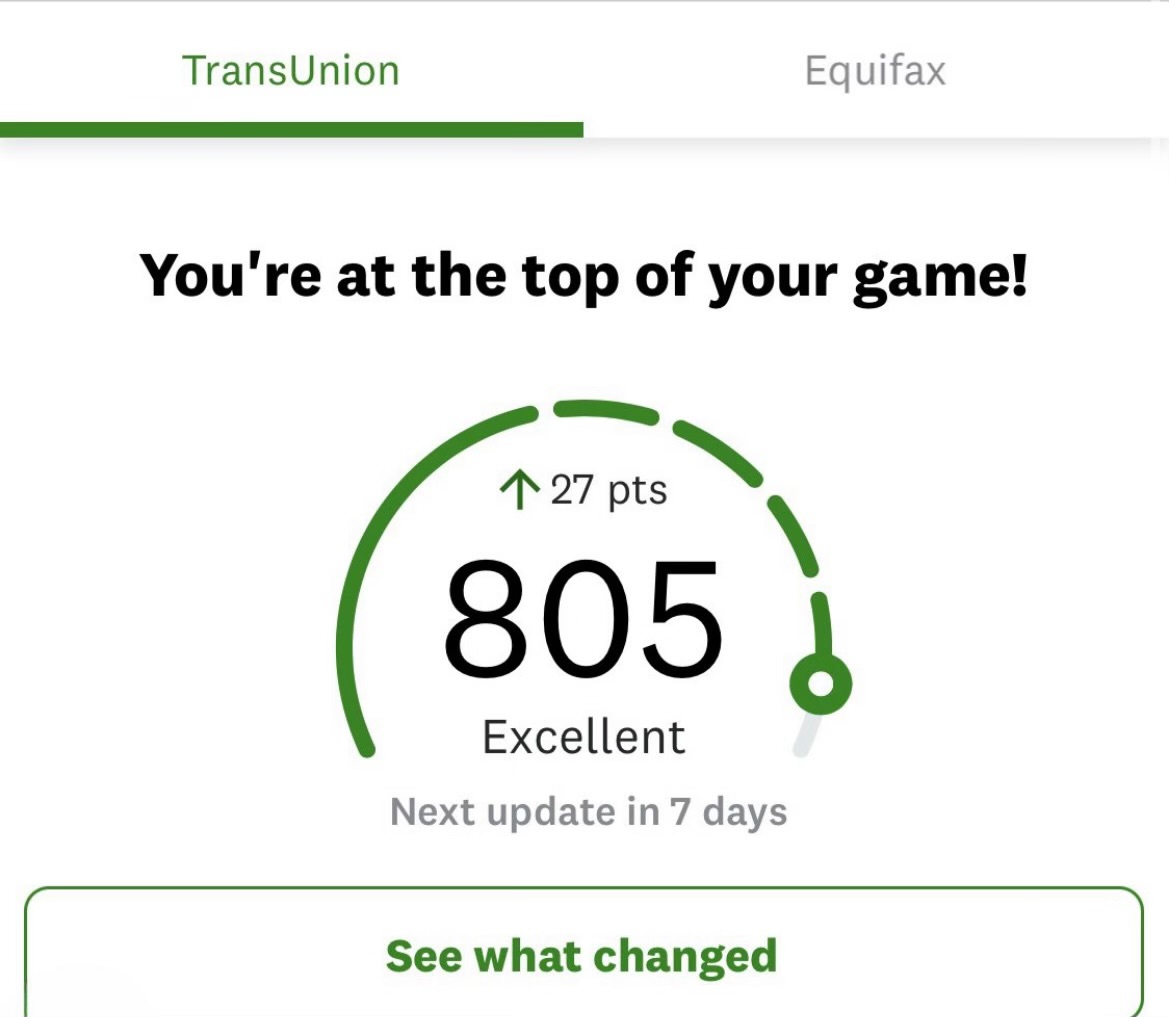

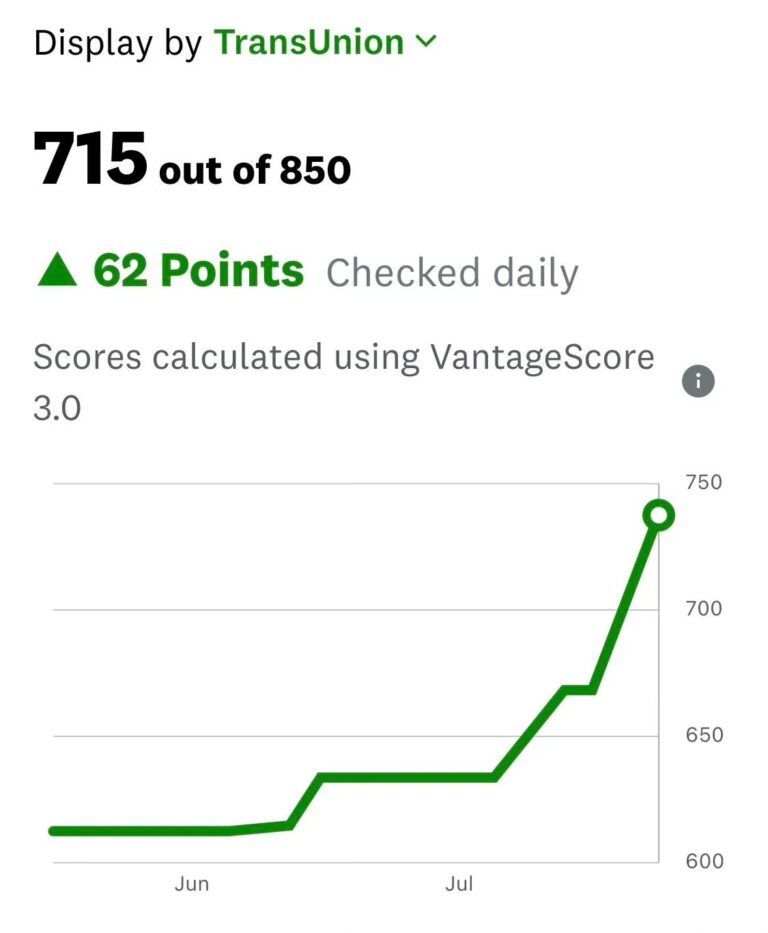

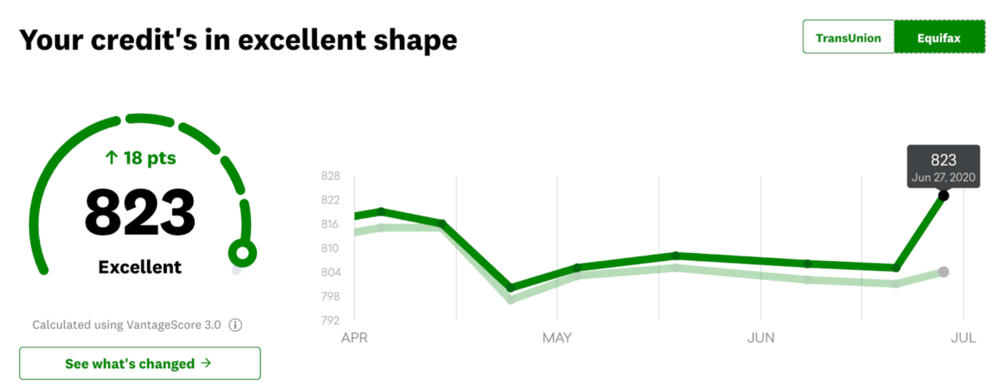

At Themostwiseinvestments, we’re dedicated to helping you achieve financial freedom by boosting your credit score and managing your credit effectively. With a proven track record of increasing credit scores by an average of 50+ points, we’ve successfully helped over 200 clients improve their financial standing. Our advanced credit management software creates personalized, detailed payment plans designed to pay off debts efficiently, giving you a clear path to a stronger financial future. Let us guide you to a better credit score and the financial stability you deserve.

Credit management is your company’s action plan to guard against late payments or defaults by your customers. An effective credit management plan uses a continuous, proactive process of identifying risks, evaluating their potential for loss and strategically guarding against the inherent risks of extending credit. Having a credit management plan helps protect your business’s cash flow, optimizes performance, and reduces the possibility that a default will adversely impact your business.

A Tradeline is the credit industry’s term for an account on a credit report. Credit card accounts, personal loans, and mortgages are all examples of a tradeline that would appear on a credit report. Unsecured credit means that debt on the card is not backed or secured by collateral. All the lender has is your promise to pay it back.A secured credit card is a type of credit card that is backed by a cash deposit from the cardholder. This deposit acts as collateral on the account, providing the card issuer with security in case the cardholder can’t make payment. Lenders use your credit score to determine whether they are willing to loan you money and, in many cases, what interest rate you will be charged. The higher your score, the less risky you appear as a borrower and the more likely you are to receive approval for new accounts and to receive a favorable interest rates.

If you pay rent online, you might be able to add it to our Credit Boost – along with your other bills. Find out if your rent payment is eligible. Only online residential rent payments made to property management companies or rent payment platforms that are eligible to Boost. Rent payments made with cash, money order, personal check or on a mobile payment transfer app (like PayPal, Venmo or Zelle®) aren’t eligible.Bills like phone payments, water, car loan payments, credit card payments, and electric bills are elgible for credit boost.

Why is Good Credit so Important ?

Access to Loans: Good credit makes it easier to qualify for loans, such as mortgages, car loans, and personal loans. Lenders use your credit score to assess your creditworthiness and determine the interest rate you’ll receive.

Lower Interest Rates: With good credit, you’re more likely to qualify for lower interest rates on loans and credit cards. This can save you money over time by reducing the amount of interest you pay.

Renting and Utilities: Landlords often check credit scores before renting out apartments or homes. Utility companies may also check credit when setting up new accounts. Good credit can make it easier to secure housing and utilities.

Employment Opportunities: Some employers may check credit reports as part of the hiring process, especially for positions that involve handling finances or sensitive information. A good credit history can enhance your employment prospects.

Insurance Rates: Insurance companies may use credit scores to determine premiums for auto and homeowners insurance. A higher credit score could lead to lower insurance rates.

Building Wealth: Establishing and maintaining good credit is an essential step in building wealth. It allows you to take advantage of opportunities for investing, buying property, and growing your financial assets.

Overall, maintaining good credit is crucial for achieving financial stability and flexibility in various aspects of life.

How Do we keep your information safe ?We use bank-level SSL security encryption to make sure your data is safe when you connect your accounts and add your bills. It’s our top priority to protect your personal information.

-

Instant Credit Boost 50$

Credit will immediately boost within 5 minutes if eligible.

-

Add a Tradeline 40$

The consumer pays for the tradeline & Tradeline fee of 40$. 50% off for multiple bought tradelines.

-

Credit Removal 75$

We dispute and remove inaccurate, outdated, or unverifiable items from your credit report. Results can begin showing within 7–14 business days depending on your credit history and responsiveness.

-

Sell Your Tradeline 20%

You can set the price for the tradeline you decide to sell. We don't get paid until you get paid.

Credit Removal & Debt Sweep

Step 1.

Step 2.

Step 3.

Instant Credit Boost

Our Instant Credit Boost is efficient and consistent. The credit boost comes from tradelines you may already have but aren't reported on your credit. We use our multi-generated system to find consistent payments to report to your credit and this can cause an average of 10-50 point increase Instantly. As long as your still making payments to the companies reported, the tradelines will stay on your credit for repeated increases. Click Below to apply for an Instant Credit Boost.

Add Tradelines To your Credit Report

Adding Tradelines to your Credit as an Authorized user could have more significant affects to your credit Far as 30-100 points depending on the quality of the tradeline. We offer upfront available Tradelines but first we will get a credit report to see what sector of your credit needs the most work. Then we will offer tradelines In that category of your credit that will be the biggest Increase. Click below to Buy a Tradeline

Credit Removal & Debt consolidation

Credit Removal & Debt Sweep Our Credit Removal service is designed to help you take control of your financial profile by eliminating inaccurate, outdated, or unverifiable negative items. We use advanced dispute strategies to work directly with the credit bureaus and creditors to remove collections, late payments, charge-offs, and more. This process can result in significant score increases and a cleaner credit report within weeks. As part of our Debt Sweep, we assess your entire credit report and develop a plan to remove or resolve harmful accounts. You’ll receive personalized support and updates along the way. Click below to begin your Credit Removal process.

Sell Your Tradelines

What is Tradeline Selling? Tradeline selling is the act of adding a stranger as an authorized user on a credit card, allowing them to increase their credit score by staying on your credit. This “credit piggybacking" is an increasingly popular way to profit from your unused credit. By allowing someone with little or no credit history to build credit as an authorized user on your credit card, you can make money while barely having to lift a finger.

Business Credit

Business Credit is a gauge of a business’s creditworthiness, or ability to repay loans based on its credit history and other factors. Business credit separates the financial obligations and aspects of a business from its owner, allowing the business to generate its own creditworthiness rating.

Business credit scores range from zero to 100 and most small business lending companies require a minimum business credit score of 75.

It enables you to obtain the capital you need to expand, cover day to day expenses, purchase inventory, hire additional staff and allows you to conserve the cash on hand to cover your cost of doing business. By taking the necessary steps to build business credit the more financial opportunities your business will have.

Click the button “Business credit boost” to get your business credit boosted or started !

Consult with us so we can understand what we need from you. Click the Dates in the bottom of the page to get started

We Partnered with these companies above to assure the growth of your credit score. We Use the 3 Credit Bureaus to report various tradelines and also Track changes to your credit report. We also Review your current & Past Credit reports to eliminate any old blemishes in your credit.

Welcome to Third Party Lending !

At Themostwiseinvestments, we specialize in providing tailored lending solutions that empower our clients to achieve their financial goals. Whether you’re looking to secure a car loan, purchase a home, start or expand your business, or obtain credit lines and credit cards, we’ve successfully helped over 125 individuals get the funding they need. Our commitment goes beyond just securing loans..we also create customized debt repayment plans to ensure you can manage and pay off your loans efficiently. With Themostwise Financials, you’re not just getting a loan; you’re gaining a partner in your financial journey.

Loans are financial instruments where one party, typically a lender such as a bank or financial institution, provides money to another party, known as the borrower, with the expectation that the borrower will repay the money with interest over time. Loans serve various purposes and come in different types, including:

Personal Loans: These are unsecured loans that individuals borrow for personal use, such as consolidating debt, covering unexpected expenses, or financing major purchases like a car or home improvements. Personal loans typically have fixed interest rates and repayment terms.

Mortgages : A mortgage is a loan used to finance the purchase of real estate, such as a home or investment property. Mortgages are secured by the property being purchased, and borrowers repay the loan, plus interest, over a set period, often 15 to 30 years.

Auto Loans: Auto loans are used to finance the purchase of a vehicle. They can be obtained from banks, credit unions, or auto dealerships and are secured by the vehicle being financed. Auto loans typically have fixed interest rates and repayment terms ranging from two to seven years.

Student Loans: These loans are used to finance higher education expenses, such as tuition, fees, and living expenses. Student loans may be issued by the government or private lenders and typically have fixed or variable interest rates and various repayment options.

BusinessLoans: Business loans are used by businesses to finance operations, expansion, equipment purchases, or other business needs. They can be secured or unsecured and may have fixed or variable interest rates and repayment terms tailored to the specific needs of the business.

Credit Cards: Credit cards are a form of revolving credit that allows cardholders to borrow money up to a certain credit limit to make purchases.

Cardholders are required to repay the borrowed amount, plus interest, within a specified period, typically monthly. Credit cards often have higher interest rates compared to other types of loans.

When applying for a loan, borrowers are typically required to meet certain eligibility criteria, such as having a good credit score, stable income, and sufficient collateral (for secured loans).

Lenders asses the borrower’s creditworthiness and determine the loan amount, interest rate, and repayment terms based on factors such as credit history, income, debt-to-income ratio, and the purpose of the loan. It’s important for borrowers to carefully review the terms and conditions of a loan before agreeing to ensure they understand their obligations and can comfortably afford the repayments.

Why are loans beneficial ?

Access to Funds : Loans provide individuals and businesses with access to funds they may not have readily available. Whether it’s for purchasing a home, starting a business, financing education, or covering unexpected expenses, loans can provide the necessary capital to achieve financial goals and address financial needs.

Flexible Repayment Options: Many loans offer flexible repayment options, allowing borrowers to choose repayment terms that suit their financial situation. For example, borrowers may have the option to choose between fixed or variable interest rates, select longer or shorter repayment periods, or make extra payments to pay off the loan faster.

Building Credit: Responsible borrowing and timely repayment of loans can help individuals build or improve their credit history and credit score.

A positive credit history demonstrates financial responsibility to lenders and can make it easier to quality for future loans, obtain favorable interest rates, and access other financial products and services.

investment Opportunities: Loans can be used to finance investments that have the potential to generate returns greater than the cost of borrowing. For example, a mortgage loan allows individuals to purchase a home, which can appreciate in value over time, while business loans can be used to fund expansion projects or acquire assets that generate revenue.

Leverage: Loans enable individuals and businesses to leverage their existing assets or resources to access additional funds. By using borrowed funds, borrowers can increase their purchasing power and capitalize on opportunities that may not be feasible with their own capital alone.

Emergency Preparedness: Having access to credit through loans can provide a financial safety net in case of emergencies, such as unexpected medical expenses, home repairs, or job loss. Having funds available through loans can help individuals and businesses navigate challenging times and maintain financial stability.

A Third-party lender is a company that provides loans to companies or customers by taking on the risk of default. Third-party lending services come in many forms and functions. In today’s market, they are frequently online lenders. Our Third party Lending process is easier then Bank Loans. We provide Loans for all Tax Brackets & Credit Scores

How Our Third party lending work ? Our Third party lending process will be quick and simple, We have Information forms and documents that you must complete and upload to find you a direct lender. Click the button ” Find a lender” at the bottom to get started.

Step 1: Find what type of loan you are most interested in & what fits you best. We need to collect as much information as possible from you to make sure you’re applicable for the right loan. Click ” Find a lender” to get started on the information form.

Step 2: We will return to you with a list of pre-approved loans & Lenders. Also in this list will be different quotes According to what you applied for. Choose a lender and quote from this list.

Step 3: We will reach out for further documentation that we need to get you the money. While we submit those, we will also be guiding our clients on how to use the loan or refinance.

Step 4: Once you received the Funds for whatever product you want to acquire, The hard part is over. Now you may walk into a manufacturer of the product and won’t have to go through the loan process. It should be as easy as a normal checkout.

What you need for pre qualification ?

Driver’s license or U.S. passport.

Social Security card or number.If you aren’t a U.S. citizen, a copy of the front and back of your green card(s).

Credit history. Your lender will want to check your credit score.

Employment verification. Your lender wants to know you have stable employment! – They’ll likely call your current employer and ask about

Consult with us so we can understand what we need from you. Click the Dates in the bottom of the page to get started.

Frequently Asked Questions ?

How Long does Credit Boost take To Show on your Credit ?

It Takes usually take 15 – 30 days to show up on your credit report. At most it takes up to 60 days to show up on your credit report

Is Buying a Tradeline safe or will it drop your Credit Score ?

Buying a Tradeline is fully legitimate & Safe. We have to collect certain personal information that will be protected when you buy a tradeline so we make sure the tradeline you acquire is directed to you.

How Do You sell Your Tradelines ?

When You receive a buyer for your tradeline. We will direct you to make sure you add the right person to your Tradeline and receive proper funds. The processs will consist of contacting your financial institution & adding the individual to your selected tradeline.